Make America Great Again Personal Bank Checks

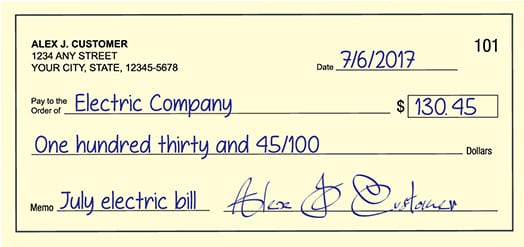

How to write a check.

Filling out a check for the first time or for the first time in a while? You might have questions, such as where to sign a bank check and how to write a check with cents. While you might non write many checks, it'south notwithstanding an of import skill to accept. Let united states of america answer your questions with a quick how-to.

Step i: Appointment the check

Write the date on the line at the acme right-hand corner. This step is important so the bank and/or person you are giving the bank check to knows when you wrote it.

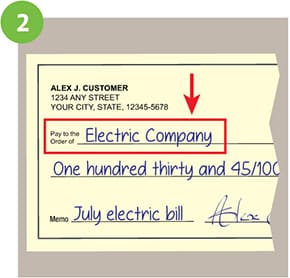

Step 2: Who is this cheque for?

The next line on the bank check, "Pay to the order of," is where y'all write the proper name of the person or company you lot want to pay. Yous can also but write the word "cash" if you don't know the person or organization's exact name. Be aware, though, that this can be risky if the check ever gets lost or stolen. Anybody can greenbacks or eolith a check made out to "cash."

Pace iii: Write the payment amount in numbers

There are ii spots on a bank check where you write the corporeality you are paying. Commencement, you'll need to write the dollar amount numerically (for case $130.45) in the small box on the correct. Be sure to write this clearly then the ATM and/or bank can accurately decrease this amount from your account.

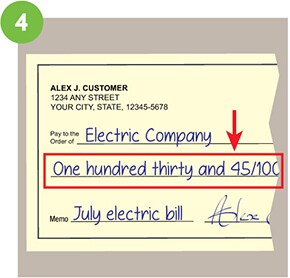

Step 4: Write the payment amount in words

On the line below "Pay to the order of," write out the dollar amount in words to match the numerical dollar amount you wrote in the box. For example, if y'all are paying $130.45, you volition write "one hundred thirty and 45/100." To write a check with cents, be sure to put the cents amount over 100. If the dollar amount is a circular number, notwithstanding include "and 00/100" for boosted clarity. Writing the dollar amount in words is important for a bank to process a check as it confirms the correct payment total.

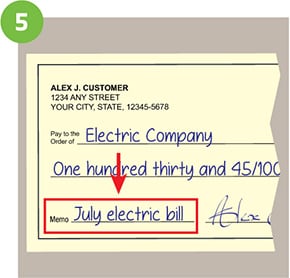

Step 5: Write a memo

Filling out the line that says "Memo" is optional, but helpful for knowing why you wrote the cheque. If you are paying a check for a monthly electric bill or hire, y'all can write "Electric Bill" or "Monthly Rent" in the memo expanse. Ofttimes when you are paying a nib, the company will ask yous to write your business relationship number on the check in the memo surface area.

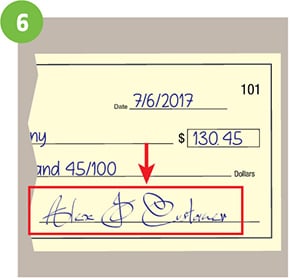

Step 6: Sign the check

Sign your name on the line at the bottom right-hand corner using the signature you used when yous opened the checking account. This shows the depository financial institution that you agree that you are paying the stated amount and to the correct payee.

How to balance a checkbook.

Every time you spend money or make a deposit, you should keep rail of this in your checkbook's cheque register, which can exist plant with the checks you received from Huntington. Your check register is meant to be used for keeping runway of your deposits and expenses. All transactions should be recorded, including checks, ATM withdrawals, debit card payments, and deposits.

Record your transactions.

- If you lot make a payment by check, you will record the check number, found in the top right corner of the check. This too helps you lot keep rails of your checks, helping you ensure none of your checks are missing, and reminding you when yous demand to reorder checks.

- Exist sure to brand note of the date for your records. In the "Transaction" or "Description" cavalcade, describe where the payment was made or for what. Then write down the exact corporeality in either the withdrawal or deposit cavalcade depending on if yous spent money or received it.

- Decrease the amount of any checks, withdrawals, payments and banking concern fees or add in deposits to the total corporeality in your account from the previous transaction.

Reconcile your banking concern statement each month.

When you receive your monthly bank statement, whether it comes in the mail or you view it online, take the time to residual your checking account. First, download our Balancing Worksheet. And so follow the directions to enter the information from your checkbook annals and bank business relationship statement as well as whatsoever unlisted deposits and outstanding checking/withdrawals. Once you are finished with the worksheet, if your adapted checkbook and account residue friction match, your checking account is counterbalanced!

If there are differences, take the fourth dimension to check your math, see if there are outstanding checks that might not bear witness on your statement yet, and double-bank check to ensure y'all didn't miss a fee or transaction. If yous believe there is an fault on your depository financial institution statement, contact Huntington as presently every bit possible.

Balancing your checkbook may experience outdated with online banking, mobile banking, and budgeting engineering. While your Online Cyberbanking history allows you lot to check your business relationship residuum and runway your spending on a regular basis, there are all the same benefits to balancing your checkbook each month (or even each week).

For example, if y'all wrote someone a check and they haven't cashed information technology nonetheless, that amount won't exist listed in your online history, but it will be in your check register. Having authentic knowledge of payments y'all have fabricated can help you avert overdrafts or return fees. Additionally, keeping a second record of your transactions could assistance y'all spot potential instances of fraud.

All out of checks?

No problem! Hands order checks online from Huntington.

Ready to open upward a Huntington checking business relationship?

Observe out which account blazon is right for you.

Get Started

Nosotros are here to assistance.

If y'all can't find what you're looking for, allow us know. We're ready to help in person, online or on the telephone.

Telephone call Us

To speak to a customer service representative, call (800) 480-2265.

blackmanalletwonesed77.blogspot.com

Source: https://www.huntington.com/learn/checking-basics/how-to-write-a-check

0 Response to "Make America Great Again Personal Bank Checks"

Post a Comment